Dear daughter,

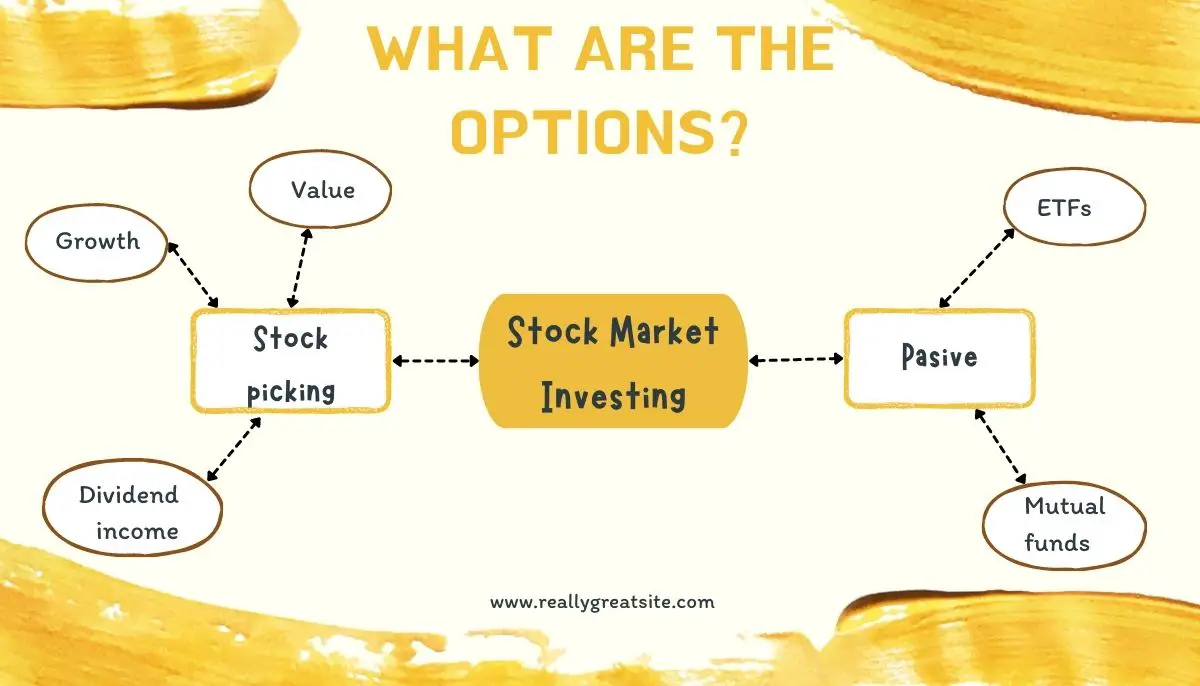

There are several options available to invest in the stock market. Which one is (are) the best for you? It depends on how much time you are willing to spend doing the due diligence.

Investors call due diligence to what they do to really understand the business. The sentence is short, but what needs to be done is a lot. At least if you want to do stock picking.

You have basically a few choices depending on the time you are willing to put into it.

The first choice is to buy stocks by picking them yourself according to a certain strategy. The second one is to buy an index fund or several.

Investing in stocks

If you are willing to spend a lot of time doing the due diligence and learn a lot, then you can do stock picking. You will really learn to be an investor if you do stock picking.

If this is your case, you might have to decide what strategy to follow: value investing, growth investing, or investing for dividend income.

Let’s examine here the concept behind the three strategies I mentioned before.

Value investing

Value investing is a strategy that some investors follow. They always buy the stock at a discount to the intrinsic value of the business.

Let’s say when you calculate the intrinsic value of a business (one of the ways of doing that is using the Discounted Cash Flow), you find out that the intrinsic value of the business, its fair price to you, is $100. But the stock is selling on the stock market at $70.

In other words, the stock is on sale for 30% off.

There are many reasons why a stock price is less than the intrinsic value of the business. When an investor is actively looking for this type of business, and he/she understand that the price tag is wrong (or the business is on sale), then is the right moment for the value investor to buy.

Eventually, the stock price will match the intrinsic value of the business. At that time the value investor can sell and get a profit. Or it can keep holding the business for a longer-term. I’ll say the decision here depends on how better the return on investment can be if you hold for a longer time. This is a short question that is difficult to answer and yes, it needs due diligence.

Growth investing

Grow investing is a strategy where the investor looks for a business that can have exponential growth. These are usually businesses that are at an early stage or/and are in a volatile sector of the economy. For instance, pharmaceutical companies, technology companies, etc.

This type of business can have huge growth in a short period. They are also risky businesses that can easily go bankrupt or lose value.

Investing for dividend income

When you want to live from your stock market investments without doing anything else, these are your go-to choice.

I mentioned to you here that when you buy shares in a business you are entitled to a percentage of the business’s profit.

The businesses keep part of the profit to grow in certain areas, to invest in research, pay debts, etc. The other part of the profits is paid to shareholders (the owners) at least once a year, sometimes more.

Some businesses don’t pay dividends, they use all the profit to invest in the business and grow. Growth stocks usually fall in this category, they don’t pay dividends, at least at the beginning. They need that money to invest, otherwise, they won’t grow.

There are certain stocks called the dividend aristocrat. These are companies that increased the dividends they pay to the shareholders in the last 25 years.

These companies are well-established and probably won’t fall in the growth stock category.

If you buy a dividend aristocrat stock, you know that there are high probabilities that the dividends you receive each year will grow. Something nice for you.

Passive investing

This will be a lazy way of investing. Don’t get me wrong, there is nothing bad with being a lazy investor, or being a passive investor.

This means that you don’t have the time, or don’t want to put in the time and effort, to do the due diligence.

In this case, you can do two things:

- Buy an exchange-traded fund (ETF).

- Buy a mutual fund.

When you buy an ETF, you buy a basket with several stocks on it. ETF follows indexes on the stock market.

A very popular index is the S&P 500.

“The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. According to our Annual Survey of Assets, an estimated USD 13.5 trillion is indexed or benchmarked to the index, with indexed assets comprising approximately USD 5.4 trillion of this total (as of Dec. 31, 2020). The index includes 500 leading companies and covers approximately 80% of available market capitalization.” Source.

Several ETFs track this index. If a company goes out of the index, and another goes in, the ETF is updated.

ETFs are managed by companies like Vanguard. The great thing about ETFs is the low investment costs. Usually less than 0.5%. This is very attractive to passive investors.

The other option in this category is to buy a mutual fund.

Mutual funds are actively managed by professional money managers. This increases the management cost, usually around 2% of the money invested. This means that every year, without regard if your money is growing, the mutual fund company gets around 2% of the money you have invested.

Also, there is a statistic that shows that more than 90% of money managers underperform the market. This means that is just logical to invest in an ETF that tracks the market, you pay fewer fees, and you will get average returns.

There are other options like trading, Options, Futures, and others. But for me, that is gambling and therefore I don’t want to talk to you about that, they are not an option for me. Some of the “financial innovations” are the root of recessions. There are several examples. With this, I just want to tell you that the fact that something is there, and you can use it, doesn’t mean you should.

So, what option is the best for you?

Love you, Dad.