Dear daughter,

Today I want to tell you about mortgages.

Yesterday, I had a conversation with a couple of friends, and I found out that they don’t know what an amortization schedule is, or how much they have to pay in interest even though they both have a mortgage.

And because of this, I want to explain it to you. So, when this topic comes your way, you are well informed.

Mortgage definition

According to Investopedia, “The term “mortgage” refers to a loan used to purchase or maintain a home, land, or other types of real estate. The borrower agrees to pay the lender over time, typically in a series of regular payments that are divided into principal and interest. The property serves as collateral to secure the loan.”

From here, there are a few things that have an impact on the mortgage itself:

- The length of the mortgage is usually 20 or 30 years.

- The interest rate. This defines the interest you must pay the lender.

- The premium. The amount of money you must pay each month. This will depend on the length of the mortgage and the interest rate.

If you search on the internet, you will find several types of mortgages, depending on the country, and many things and terms that only make the whole thing more difficult to understand. Remember, some professionals make a living from explaining or recommending based on the difficulties that only they know and can give advice.

One important thing to have when you have a mortgage is the amortization schedule. This is a table that shows how much you must pay every month, and during the length of the mortgage, divided by principal and interest. From these numbers, you can learn several things about what is best for you.

How do the numbers work on the mortgage?

The interest rate, the remaining time of the mortgage, and the money that you still owe to the lender define how much you pay in interest every month.

The monthly payments are divided into interest and principal.

The interest goes in full to the lender, that’s what you pay in exchange for the money the lender borrowed you.

The amount that goes to the principal, reduces the amount you owe to the lender. When the principal goes down to zero, you finished paying the mortgage.

So, let me show you an example of how this work.

A mortgage example

Let’s say you want to buy a house that cost $ 200 000, you will make a down payment of 10%, and the mortgage will be for 30 years at a 5.25% interest rate.

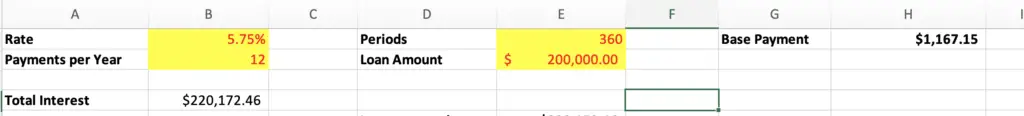

With those numbers, you will have to pay $1,117.15 per month over 30 years. Also, the total interest you will pay to the lender is $ 220,172.46. See the figure below.

Yes, I know, it is hard to see that you have to pay for more than 2 houses to have 1 for yourself.

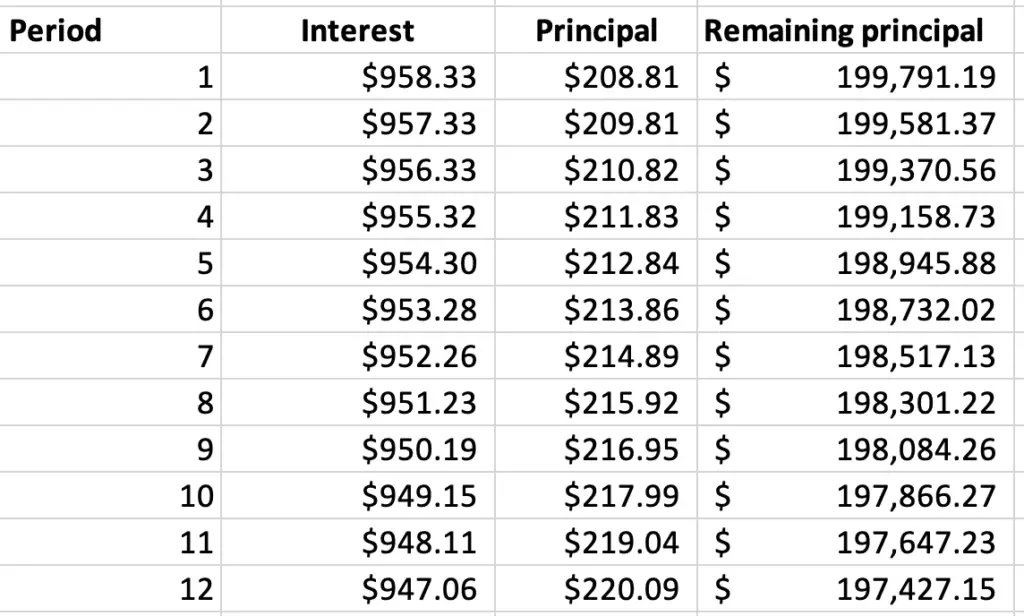

See below the amortization schedule for the first year. Notice the percentage of the payment that goes to the interest and what goes to the principal. The total interest paid in the first year is $11,432.90 and the total that goes to the principal is $2,572.85.

But, there are two things you can do to avoid paying that much interest on a mortgage.

As I told you before, when you look at the numbers, you can get the real picture, not the one someone is selling to you. You need to do the numbers yourself.

I wrote a guide for you to help you understand how you can calculate mortgage interest and principal payments.

Two things you can do to pay less or no interest

The first thing is trivial, don’t borrow money.

Yes, my daughter, I hear you. How can I then buy a house if I don’t have all that money?

If you save and invest enough money, eventually you can buy a house without borrowing money.

Like everything in life, this approach has pros and cons. The pro is that you won’t owe money to anyone and because of that you will end up paying less for your house. The con is that you will have to wait several years to start living in your house.

The second thing you can do is to get the mortgage and do regular extra payments.

Why this will save money in the interest that you pay?

If you have to pay interest on the money you still owe, the less money you owe the less interest you pay.

Let me show you how this works with numbers.

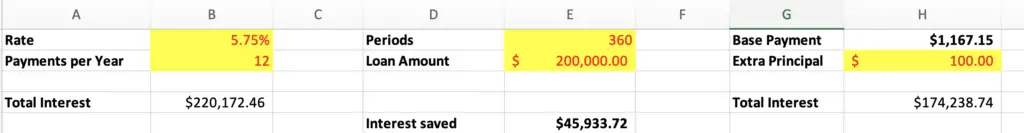

Let’s say you decide to go for the house with the figures from the previous example. But you decide that you can do extra payments of $100 every month.

The new figures will be as in the picture below.

Just by paying $100 extra every month, you will be paying $45,932.72 less in interest to the lender.

Guess what you can do with that money you saved. Yes, you can invest it for your own benefit instead of giving it to the lender.

Not only you will pay less, but you will finish paying the mortgage in less time. In this case, you will pay the mortgage in full in 24.6 years instead of 30 years.

Guess what will happen if instead of $100 you pay $200 extra every month.

Interesting numbers, aren’t they?

These examples I gave you here, my dear daughter, shows you how important is to know the numbers when you make financial decisions.

I’ll leave the excel sheet template that I used to do these calculations here, so you can play with the numbers to get a better understanding of how this works. Change only the numbers highlighted in yellow, the rest is calculated automatically.

Download the mortgage amortization schedule template using the form below

I trust this will help you to make better decisions regarding mortgages.

So, the next question is should you buy or rent a house?

Love you, Dad.