Dear daughter,

Today I want to introduce you to what some people call the eighth wonder of the world: compounding. Here I’ll explain to you, with examples, what compounding is and how it works.

When you invest money for a long period, and you also invest the interest you earn from the investment, your money will “compound”.

So, if you think about the process of compounding, you will realize that at first, you get earnings or interest from your investment. Then, when you reinvest your earnings, you will also earn interest on the earnings you got. In other words, you earn interest on the amount you invested, and you earn interest on the interest over time.

How does it sound?

If you don’t get it yet, you will soon when you see the numbers. Remember what I told you about financial decisions? Just in case I’ll repeat it: “Only the numbers tell you the truth”.

A critical aspect of compounding is the time of the investment. It must be a long period and you shouldn’t withdraw any money from the investment. Also, you must reinvest the earnings into the same investment vehicle.

So, in summary, long-term, reinvest the earnings, don’t withdraw equals compounding.

Let’ me show the numbers.

Example 1 of compounding: only initial payment

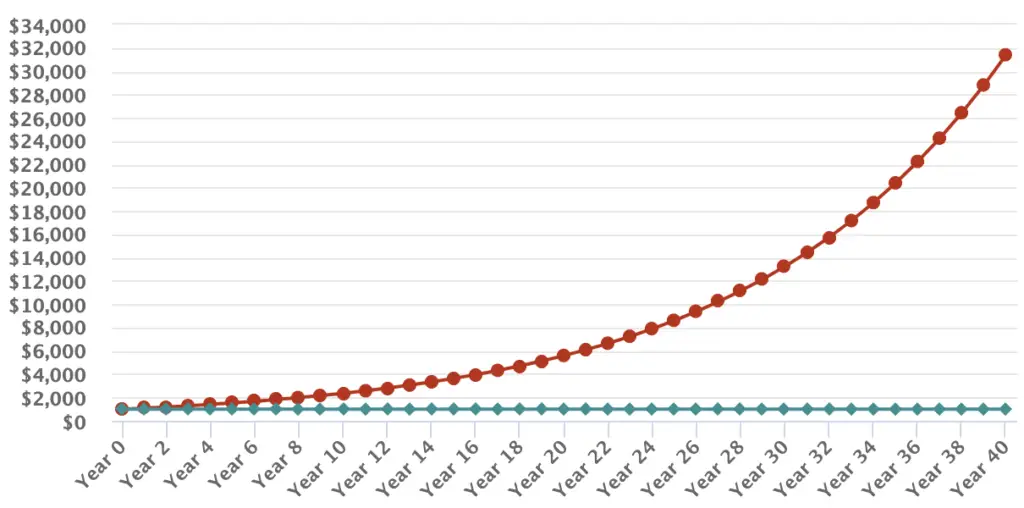

Suppose that you invest $1000, and you get a return of 9% per year.

Let me show how much you will have depending on the time you leave your money invested.

Initial amount invested: $1000.

| Year | Total amount | Total earnings |

| 1 | 1090.00 | 90 |

| 5 | 1538.62 | 538.62 |

| 10 | 2367.36 | 1367.36 |

| 15 | 3642.68 | 2642.68 |

| 20 | 5604.41 | 4604.42 |

| 25 | 8623.08 | 7623.08 |

| 30 | 13267.68 | 12267.68 |

| 40 | 31409.42 | 40409.42 |

See in the picture the effect of compounding in your initial $1000, without adding any extra money, only reinvesting the interest you get every year.

The red line shows the principal investment, which is the money that actually goes out of your pocket. In this example, is $1000. That is why you see that line does not change.

The red represents the interest you get each 2 years. Remember, you receive interest in the first $1000 the first year. In the second year, you get interest on the amount of $1090, which is the $1000 you initially invested plus the interest you get in the previous year.

In year 10, you will get interest on the initial $1000, plus on the interest you got until year 9, and so on.

As you can see from the picture and table above, the most important thing is the time you are invested. The results I showed you as an example, also assume you won’t withdraw any money for the period of the investment.

Very interesting, isn’t it?

Example 2: Making extra investment monthly

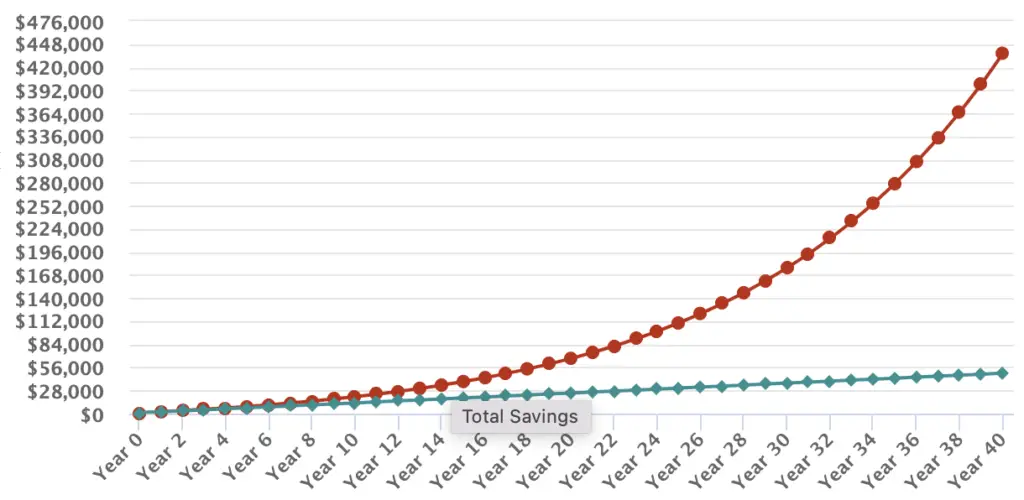

Imagine that you add just $100 every month, want to see what would happen?

I guess you do. Check the picture below.

Can you see the difference in how the red line grows?

The total number in year 30 is $176 836.72 and the total money out of your pocket is $37 000. That is a growth of 477.94 % on the money that went out of your pocket. Notice that in the previous graph the green line grows because you are adding $100 from your pocket every month.

This is a big difference, isn’t it?

The two graphs represent the power of compounding.

There are many compound interest calculators online. Here is one. I encourage you to play with some numbers so you can have an idea of how you can benefit from compounding.

So dear daughter, when are starting the process of compounding?

Love you, Dad.